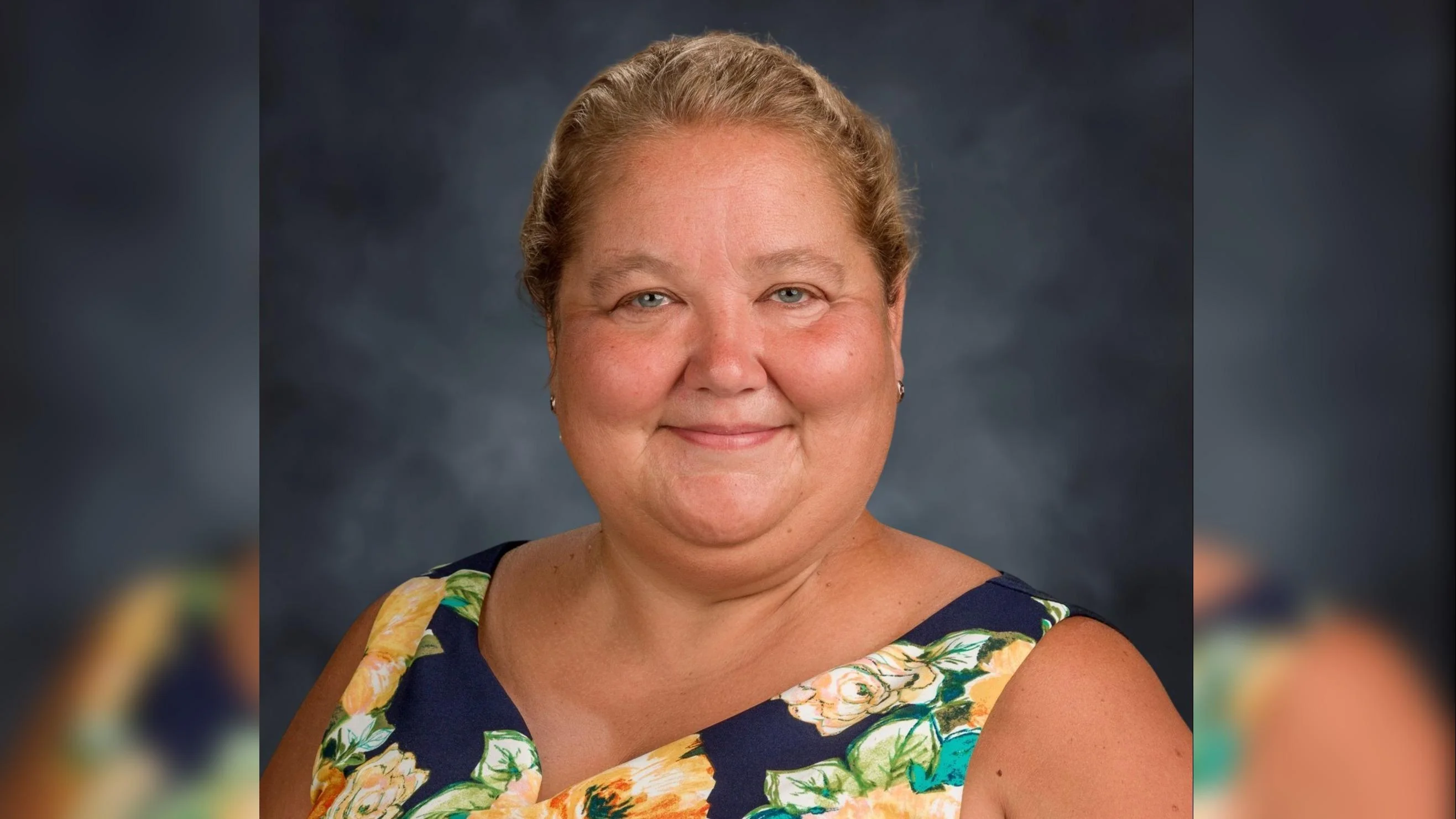

Andrea Evers Superintendent at Murphysboro Community Unit School District 186 | Official Website

Andrea Evers Superintendent at Murphysboro Community Unit School District 186 | Official Website

Under Illinois law, districts may only borrow up to a certain limit based on their Equalized Assessed Value (EAV)—a standardized measure of taxable property used to determine legal debt caps.

Based on the school district's enrollment of 6,288 students, the countywide debt translates to approximately $5,582 per student as of fiscal year 2024.

The county includes seven school districts, of which Murphysboro Community Unit School District 186 held the most debt, totaling $19.5 million.

Murphysboro Community Unit School District 186 ranked 178th statewide among all 851 Illinois districts reporting outstanding debt.

Among the school districts in Jackson County, Murphysboro Community Unit School District 186 used the highest percentage of its EAV-based debt limit at 9.9%, holding $19.5 million in outstanding debt with 1,848 students enrolled—approximately $10,578 per student. Unity Point Community Consolidated School District 140 ranked second, using 4% of its borrowing capacity with $3.3 million in long-term debt and an enrollment of 650— $5,075 per student.

Countywide, students identifying as white comprised the largest ethnic group in Jackson County schools, accounting for 60.1% of the total enrollment. The second-largest ethnic group was Black, comprising 24.2% of the student body.

The data was obtained by Wirepoints through a Freedom of Information Act request to the Illinois State Board of Education.

Illinois has enacted a law that changes the amount of debt school districts can issue. According to an analysis by Chapman, the new rules permit school districts to borrow more money than previously allowed. At the same time, the law modifies limits on property tax extensions that fund this debt. As a result, if districts take on more debt, local property taxes could increase to cover the additional costs.

The Illinois State Board of Education’s budget for fiscal year 2026 will increase from nearly $10.8 billion to about $11.2 billion. This includes a $307 million boost for K–12 schools, marking the smallest annual increase since 2020.

The agency has paused about $50 million in funding previously allocated through the Evidence-Based Funding formula for the Property Tax Relief Grant while reviewing its impact on local tax relief. Officials say the pause could affect the timing and amount of property tax relief available to taxpayers.

The annual reporting aims to increase transparency and accountability around school debt. Future reports will include 15 years of historical data, allowing residents to track long-term financial trends.

Outstanding School Debt by School District in Jackson County, FY 2024

| County Rank | State Rank | School District | Outstanding Debt | Percentage of Debt Limit Used | Percentage of EAV Used | Enrollment |

|---|---|---|---|---|---|---|

| 1 | 178 | Murphysboro Community Unit School District 186 | $19,548,333 | 71.7% | 9.9% | 1,848 |

| 2 | 470 | Carbondale Elementary School District 95 | $4,150,000 | 16.8% | 1.2% | 1,562 |

| 3 | 479 | Trico Community Unit School District 176 | $3,903,700 | 26.4% | 3.6% | 852 |

| 4 | 512 | Carbondale Community High School District 165 | $3,314,598 | 9.4% | 0.6% | 947 |

| 5 | 514 | Unity Point Community Consolidated School District 140 | $3,299,000 | 58.7% | 4% | 650 |

| 6 | 674 | DeSoto Consolidated School District 86 | $605,300 | 33.5% | 2.3% | 193 |

| 7 | 711 | Giant City Community Consolidated School District 130 | $280,000 | 8.8% | 0.6% | 236 |

ORGANIZATIONS IN THIS STORY

!RECEIVE ALERTS

DONATE

Alerts Sign-up

Alerts Sign-up