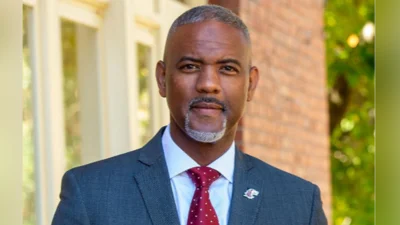

Rep. Paul Jacobs (R-Carbondale) | Photo Courtesy of Paul Jacobs website

Rep. Paul Jacobs (R-Carbondale) | Photo Courtesy of Paul Jacobs website

Illinois parents have received sales tax holidays for back-to-school purchases for the past two years but will not get a tax holiday this year despite rising supply costs.

A recent Facebook post by Illinois Rep. Paul Jacobs (R-Carbondale) brought attention to the decision. Jacobs wrote, “Democrats chose to end the back-to-school tax holiday this year despite the rising costs of supplies. Illinois families need lasting relief, not just when it's politically convenient. Let's make Illinois an affordable place to live and provide real tax relief year after year.”

Jacobs, a state representative who resides in Pomona, was first elected to the Illinois House in 2020. The Illinois House website details his legislative experience, including his time serving committees for Tourism and Higher Education.

Jacobs’ post linked to a recent WCIA article on this year's lack of tax holiday. For the first time in three years, the sales tax holiday isn't happening. The consumer price index has reported a 20% increase over two years in the cost of supplies like clothes, backpacks, notebooks and pencils. Still, the current fiscal year's budget, which started on July 1, 2023, did not include the same tax relief measures as previous years. Nonprofit groups will hold school supply drives next month to try and ease the burden on families of school-age children.

Last year, the sales tax holiday lasted from Aug. 5-14 and helped shoppers save 5% of the sales tax they would usually pay on school supplies and clothing, an ABC 7 report said. During the Illinois sales tax holiday, they lowered tax from 6.5% to 1.5%, with a family spending $200 saving about $10.

Not all items were exempted from the sales tax last year. A bulletin on the sales tax holiday in 2022, written by David Harris, Director of the Illinois Department of Revenue, outlined some qualifying items for the sales tax break. Those items included: Household and shop aprons; coats and jackets; rainwear, shirts and blouses; shorts and pants; and shoes, sneakers and steel-toed shoes. All clothing and footwear had a cost cap of $125 to qualify. Qualifying school supplies included composition books, writing tablets, scissors, binders, calculators, pens and pencils and other related items.

With no sales tax holiday this year, Jacobs isn't the only legislator expressing concern for families. In an interview with WCIA, Sen. Sally Turner (R-Lincoln) added, "We were hopeful that they would extend those tax breaks for gas and groceries. Especially during this time our kids are getting ready to go back to school."

Alerts Sign-up

Alerts Sign-up