Illinois retiree health insurance shortfalls hit $55 billion. | Canva

Illinois retiree health insurance shortfalls hit $55 billion. | Canva

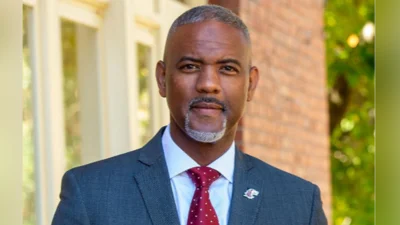

The Illinois pension debt continues to rise at an alarming rate. As the total debt surpasses $500 billion ($110,000 per household in Illinois), state Rep. Paul Jacobs is speaking out about the issue and how he feels Illinois can seek a solution.

However, in order to solve the problem, Jacobs knows that it needs to be understood to begin with.

"The pension crisis is an issue we all can agree, regardless of political party, is significant," Jacobs told the Carbondale Reporter. "Every time I have been in a debate on the campaign trail or every time I have filled out a candidate survey for a newspaper, the issue of pensions always comes up. And yet, nothing ever gets done about it. Pension reform was not even a topic of discussion last session. How can we hope to solve this problem if our political leaders won’t even allow the topic to be debated? Decades of ignoring the problem is precisely why we are looking at a $110,000 pension liability per household in Illinois."

The problem of debt to the state's pension fund isn't a new one, but it is reaching a unique status. A report found that Chicago and Cook counties owe $122 billion in pensions and retiree health, while Illinois pension obligation bonds sit $9 billion in the hole and state retiree health insurance shortfalls hit $55 billion. In total, the report says, taxpayers in Illinois are on the hook for $530 billion.

According to Jacobs, the first step is to make the issue an actual priority for the legislature.

"Let’s have some hearings," he told the Carbondale Reporter. "Let’s talk to leaders in other states that have found solutions to their pension problems and see if there are some ideas we can use here in Illinois. The people elected us to govern. Let’s do our job."

As of now, there are no proposals with any significant backing or progress in the state legislature to address the pension debt crisis.

Alerts Sign-up

Alerts Sign-up